tax return rejected dependent ssn already used

File a paper return. Social Security number and last name dont match IRS records R0000-503-02 - Rejection code for taxpayer the 02 normally signifies the second.

Common Irs Where S My Refund Questions And Errors 2022 Update

This rejection is the result of a typo on another return.

. If they have no other dependents and you filed the tax return for the daughter you may be forced to paper file which could be a PIA due to IRS shunting paper. Dont try to e-file you wont be able to if someone else already has used the social security number. The SSN in question also appears as the filer spouse or dependent on another tax return for this same year.

Then take these steps. I attempted to e-file my tax return last week and it was rejected because a return had already been filed with my SSN. The SSN in question also appears as the filer spouse or dependent on another tax return for this same year.

In most cases the taxpayers social security number ssn was entered incorrectly. If it is incorrect fix it and. File paper and the IRS will investigate and make a determination.

I contacted the vendor whom indicated many other users. The second return could be from you or the person who has stolen your information. If your return was rejected due to your dependents SSN being used on another return the first thing to do is to verify that you entered the SSN correctly in the return.

When the IRS receives two different returns with the same Social Security. Print out and mail your return claiming your dependent to the IRS. Irs rejected return ssn already used.

Whether the cause of this rejection is the result of a typo on another. By filling out this form and submitting it with your return you are alerting the IRS that your return was rejected for efiling because of a duplicate Social Security number. For example if your return is rejected because someone else uses your SSN your spouses SSN or your dependents SSN without authorization you may need to print your return.

First double check that you meet all of the requirements to claim the dependent. Your electronic filing was rejected by the IRS says an email in your inbox Your Social Security Number SSN or the SSN of someone listed on your tax return has been used. Whether the cause of this rejection is the result of a typo on another.

What Got Your Tax Return Rejected And What You Can Do About It

Is Your Tax Return Rejected Follow These Steps To Correct It

6 Times You Should Paper File Your Tax Return Dimercurio Advisors

Rejected Tax Return Here S What You Should Do

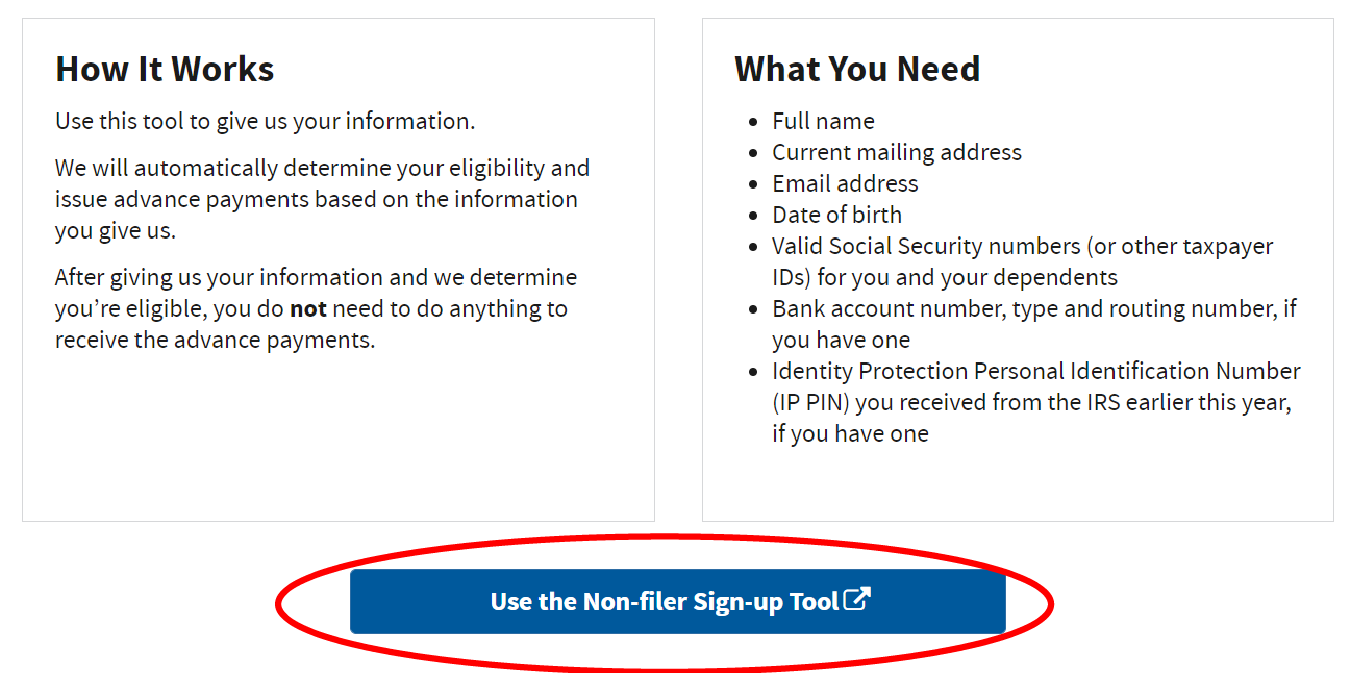

How To Fill Out The Irs Non Filer Form Get It Back

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 21 263 Irs Individual Taxpayer Identification Number Itin Real Time System Rts Internal Revenue Service

Tax Refund Status Is Still Being Processed

Itin Rejection For Married Filing Separate Steps To Fix It

Verify Yes You Can Get Missed 3rd Stimulus Cash By Filing Taxes Wusa9 Com

Why Would The Irs Reject A Tax Return Tenenbaum Law P C

What If Irs Rejects Your Efiled 1040 Or An Extension After The Deadline Internal Revenue Code Simplified

My Images For Just Lisa Now Intuit Accountants Community

Irs Identity Theft What To Do If Someone Files Taxes Using Your Ssn

Guide To Completing Irs Form 14039 Identity Theft Affidavit

Common Irs Where S My Refund Questions And Errors 2022 Update

3 11 3 Individual Income Tax Returns Internal Revenue Service

What Got Your Tax Return Rejected And What You Can Do About It